Champion for Children Tax Credit

A Powerful Way to Support CASA of St. Louis — and Reduce Your Missouri Taxes

The Champion for Children (CFC) Tax Credit allows you to make a transformative gift to CASA of St. Louis at a significantly reduced net cost to you. Your generosity directly helps children in foster care receive the advocacy, stability, and hope they deserve.

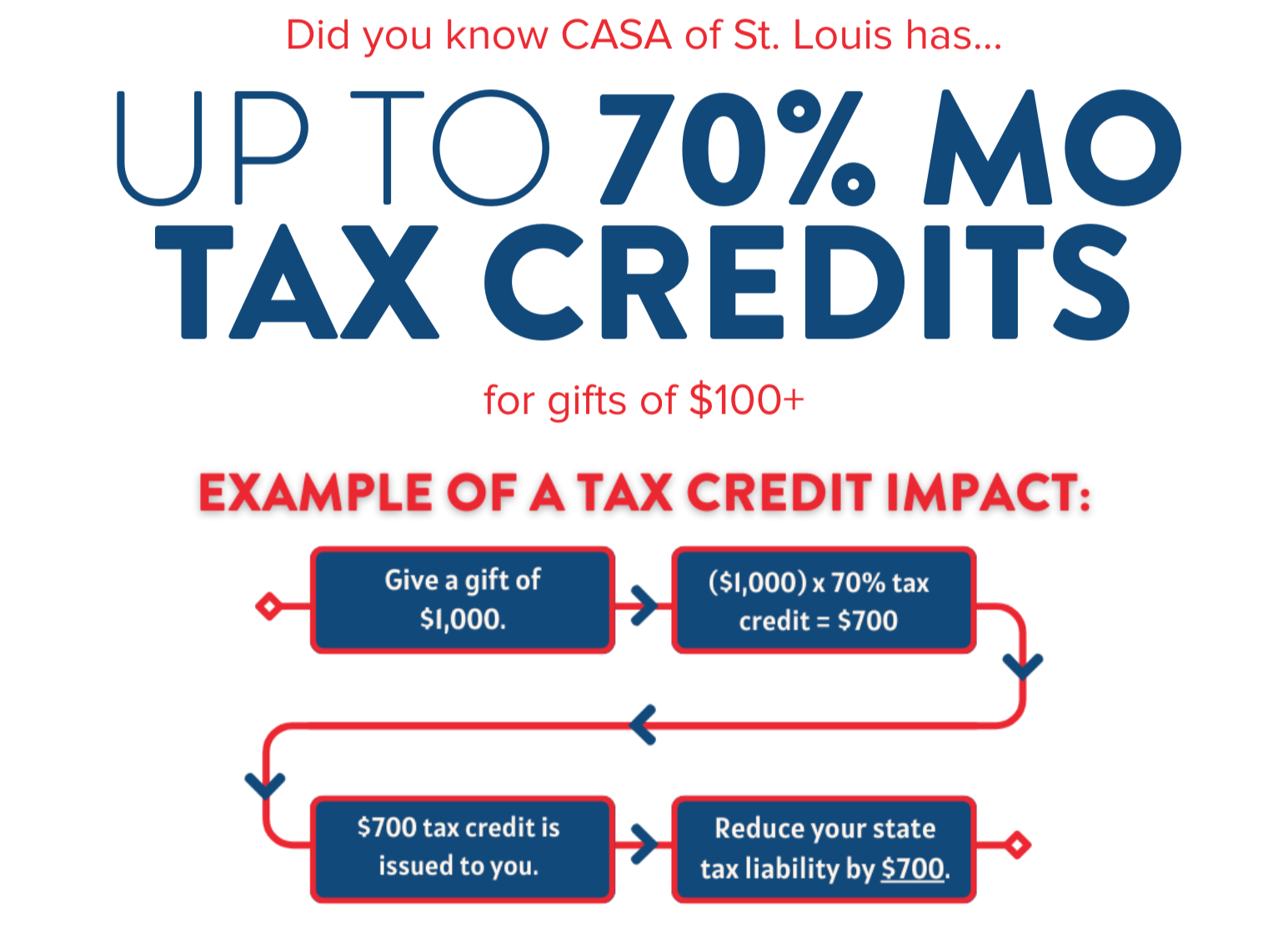

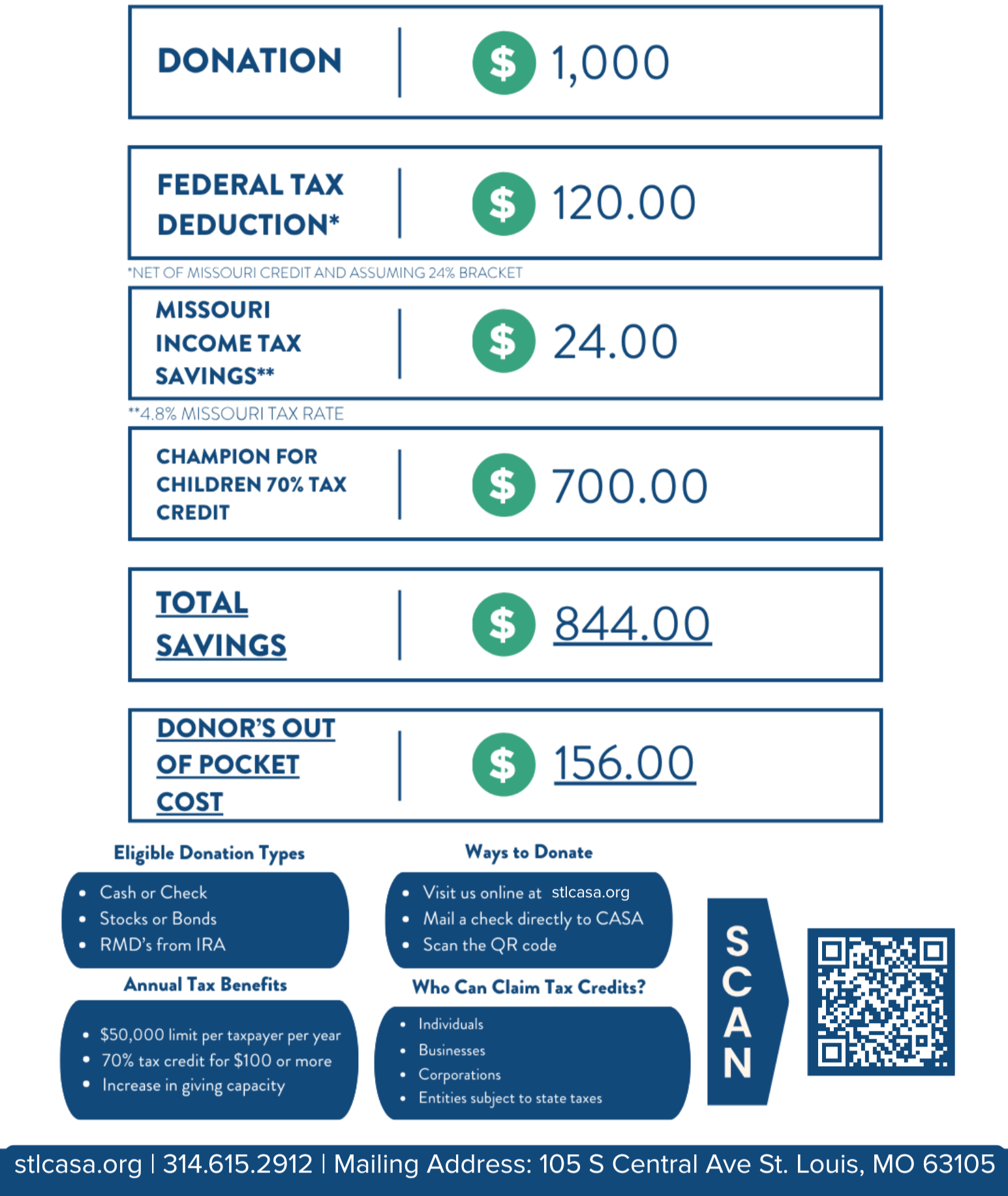

How the Credit Works

• CASA of St. Louis is an approved agency under Missouri CFC.

• You receive up to a 70% Missouri State Income Tax Credit on your donation.

• Minimum donation to qualify: $100

• Maximum credit per taxpayer per year: $50,000

• Any unused credit may be carried forward for up to 4 additional years.

• Credits apply to individuals, couples, LLCs, S-corps, corporations, and partnerships.

How to Claim Your Tax Credit

1. Make a qualifying donation to CASA of St. Louis.

2. CASA will provide a state-required contribution verification form.

3. When you file your Missouri taxes, submit Form MO-CFC and MO-TC with your return.

4. Credits may reduce the tax you owe this year—or be rolled over up to four more years.

Why It Matters

Your CFC-eligible gift helps CASA of St. Louis:

• Recruit and train more volunteers

• Serve more children who are waiting (currently 7 out of 10 have no CASA advocate)

• Strengthen advocacy for children facing abuse, neglect, and instability

• Ensure more kids find safe, permanent homes sooner

This is one of the most impactful ways to support children in foster care while receiving a significant tax benefit.